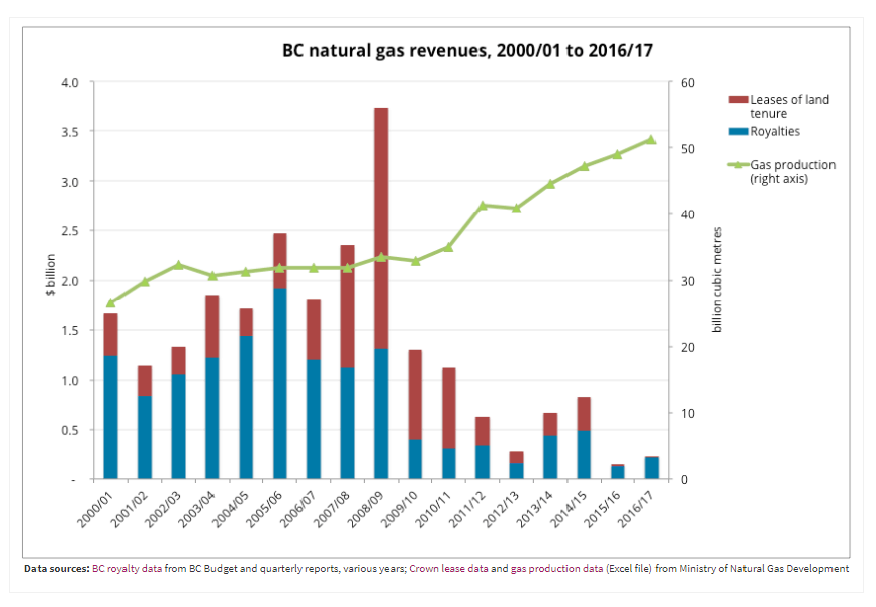

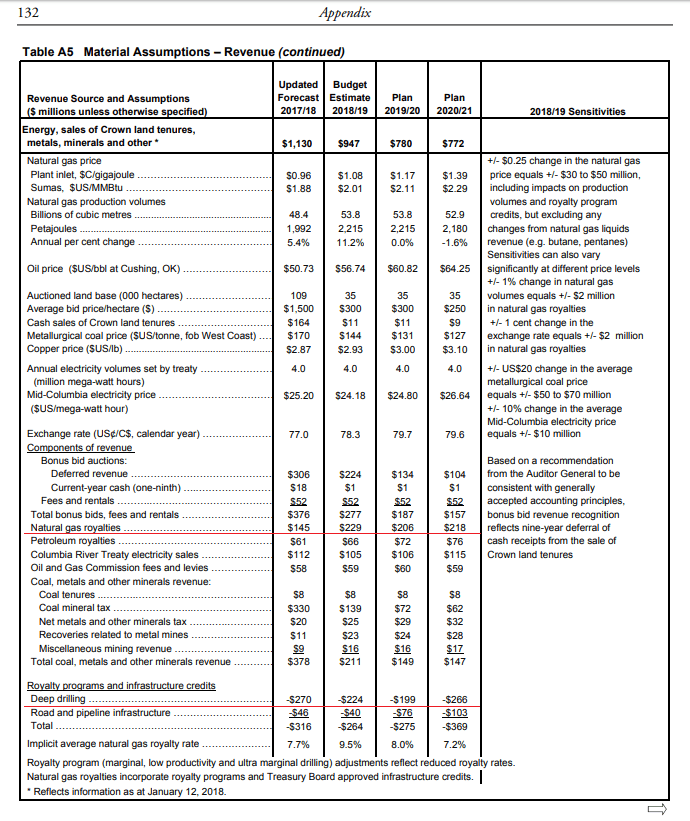

Today in Question Period, I asked the Minister of Energy, Mines and Petroleum Resources about the worrisome trend of massively decreasing revenues to BC from gas extraction. While the Minister suggested the information I presented was “not quite accurate”, I would like to point out that the information I presented is in fact BC government data. In his article BC’s natural gas giveaway: Production soars, revenues plummet, Marc Lee examined BC Royalty data from the BC Budget and quarterly reports, as well as Crown lease data and gas production data. The data presents a shocking trend – while gas production has gone from 25 billion cubic metres in 2001 to over 50 billion cubic meters in 2016/17, royalty and land lease revenues to the BC government have gone in the opposite direction, from a record $2.4 billion in 2008/09 to $139 million in 2015.  I asked the minister what specific steps she has taken to address this staggering trend, and while she pointed out that revenues have gone from $139 million in 2015/16 to $145 million in 2016/17, she did not offer any solutions for how to remedy the shockingly dismal return on the resources that are being extracted from our province. What shocks me is that she expresses no concern that while our gas extraction has doubled in the last 15 years, our revenues to the province have plummeted by 90%! My second question to the Minister was about the Deep Well Royalty Credit Program, which was introduced to enable the provincial government to share the cost of innovation for drilling in B.C.’s deep-gas basins. It has since transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. As we learned from Andrew Weaver’s questions to the Minister during budget estimates last fall, there are more than $3.2 billion in accumulated credits to industry as a result of this program. And according to the government’s budget, that number is projected to keep growing. Consider this: while revenues from natural gas royalties are predicted to be $145 million in 2017/18, the Deep Well Credits are predicted to be $270 million. And it doesn’t get any better for 2019, 2020, or 2021.

I asked the minister what specific steps she has taken to address this staggering trend, and while she pointed out that revenues have gone from $139 million in 2015/16 to $145 million in 2016/17, she did not offer any solutions for how to remedy the shockingly dismal return on the resources that are being extracted from our province. What shocks me is that she expresses no concern that while our gas extraction has doubled in the last 15 years, our revenues to the province have plummeted by 90%! My second question to the Minister was about the Deep Well Royalty Credit Program, which was introduced to enable the provincial government to share the cost of innovation for drilling in B.C.’s deep-gas basins. It has since transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. As we learned from Andrew Weaver’s questions to the Minister during budget estimates last fall, there are more than $3.2 billion in accumulated credits to industry as a result of this program. And according to the government’s budget, that number is projected to keep growing. Consider this: while revenues from natural gas royalties are predicted to be $145 million in 2017/18, the Deep Well Credits are predicted to be $270 million. And it doesn’t get any better for 2019, 2020, or 2021.

Does the Minister intend to end this credit program? Apparently not – and so the economic and generational sellout will continue. Here is the video of my exchange with the Minister, with the transcripts below.

Hansard transcript

Furstenau: For a time, in B.C., we received huge annual royalty revenues from our natural gas sector that helped pay for essential public services, but those days are gone. Even worse, B.C. has been essentially giving away gas worth billions without a fair return to the public treasury.

As Marc Lee writes: “Royalty regimes are supposed to capture a fair share of economic rent for the extraction of resources that are owned by the public. This is particularly important for non-renewable resources like gas, because once they’re extracted, they’re gone forever.” While B.C. gas production has continued to increase, the royalty revenues in this province have plummeted from $2 billion in 2005 to $139 million in 2015. We are giving away more gas for less money while barrelling past our climate commitments.

To the Minister of Energy, Mines and Petroleum Resources, what specific steps has the minister done to remedy this staggering economic and generational sellout?

Hon. M. Mungall: Thank you to the member for the question. However, the information she is presenting is not quite accurate. I’ve offered to provide the Green caucus, several times, with a briefing on this particular issue. That offer still stands, and I’m very happy to take the time whenever they’re available to get the information.

So what we’re talking about is the deep well royalty program. I just want to remind the member that last year, we received $145 million in royalties.

But what’s important to this program, which provides credits, is that not all credits are actually realized — that while credits might be banked, they might not actually be claimed. There’s a variety of reasons that determine that.

One of the important things to note in all of this is that minimum royalty payments are required. They ensure that a company always contributes to the province

Realized — that while credits might be banked, they might not actually be claimed. There are a variety of reasons that determine that.

One of the important things to note in all of this is that minimum royalty payments are required. They ensure that a company always contributes to the province, no matter how many credits they may have.

Mr. Speaker: House Leader, Third Party, on a supplemental.

Furstenau: I’d like to point out I talked about the revenues that we have received as a province. As our gas production has increased, our revenues have plummeted from $2 billion in 2005 to $139 million in 2015, with more gas being exported from our province. I’m deeply concerned that the minister doesn’t find this as troubling as we do.

The deep-well royalty program was designed to enable the provincial government to share the cost of innovation for drilling in B.C.’s deep-gas basins. It has since transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. We already know that B.C. earns very little from its natural gas royalties. Worse still, there is more $3.2 billion in unclaimed credits that can be applied against future royalties.

The minister doesn’t seem too concerned that we have a $3.2 billion fracking debt. However, I think that should be a concern for every citizen in B.C.

To the Minister of Energy, Mines and Petroleum Resources: will the minister terminate the deep-well royalty program and focus on supporting innovation in the B.C. economy that will lead our province towards a low-carbon economy?

Hon. M. Mungall: The member would likely know that we have commenced a hydraulic fracturing review scientific panel that is looking at the practice of hydraulic fracturing, specifically to look at those innovations that she mentioned.

However, when it comes to the deep-well royalty credit program, again, her characterization is not quite accurate. I’m more than happy to ensure that they get a full briefing so they understand how those credits accumulate and then how they actually are applied on a day-to-day basis within our province to ensure that not only our natural gas sector is competitive globally, but that we’re also ensuring that British Columbians receive the return on their investment and on their natural resources.